TL:DR: Nova Scotia’s Capped Assessment Program for property taxes:

Costs HRM about $100m annually in revenues (and growing)

Delivers those tax savings to the upper half of the income spectrum

Delivers it unfairly, with pricier homes having bigger savings

Lets investors get those savings on an unlimited amount of properties

Taxation is usually a struggle between two concepts:

Equity

Efficiency

Sales taxes like the HST are very efficient at raising revenue, but regressive as low income folks spend more of their income towards consumption. Corporate taxes target the rich (who own company shares), but corporations can cut back investment or move to another jurisdiction quite easily (called behavioral responses), so the economic blowback can be bigger.

Nova Scotia, sadly, has one of the worst possible tax breaks. It protects the rich from paying taxes according to how rich they are, and generates no positive behaviour other than hoarding properties. Its truly one of a kind.

Capped Assessment Program

Since 2005, every property in Nova Scotia has both an “assessed value” and “taxable assessed value”. Assessed values are best guesses of market values based on available sales, with a lag of about 2 years.

If you are a Nova Scotia resident, your taxable value will depend on when you purchased your home (municipalities must tax based on taxable assessed values). For example, if you bought a typical home in Halifax in 2008, you might have paid about $217,000 for the typical home. House prices didn’t go up much back then in Halifax (about by inflation), so you might spend the next 10 years with your assessment going up with market prices, each reaching $270,000 by 2017. Then your home value explodes, as increased immigration start to create a housing shortage, and accelerated during the pandemic. By 2022, your 217k home is worth $512k. You’ve made over $300k1.

Illustrative Example of CAP at Work

To top it off, you still pay taxes as the home is worth 301k, netting you $1,600 in tax savings annually. But think about that differently. The city only collects $2,288 on a typical property.

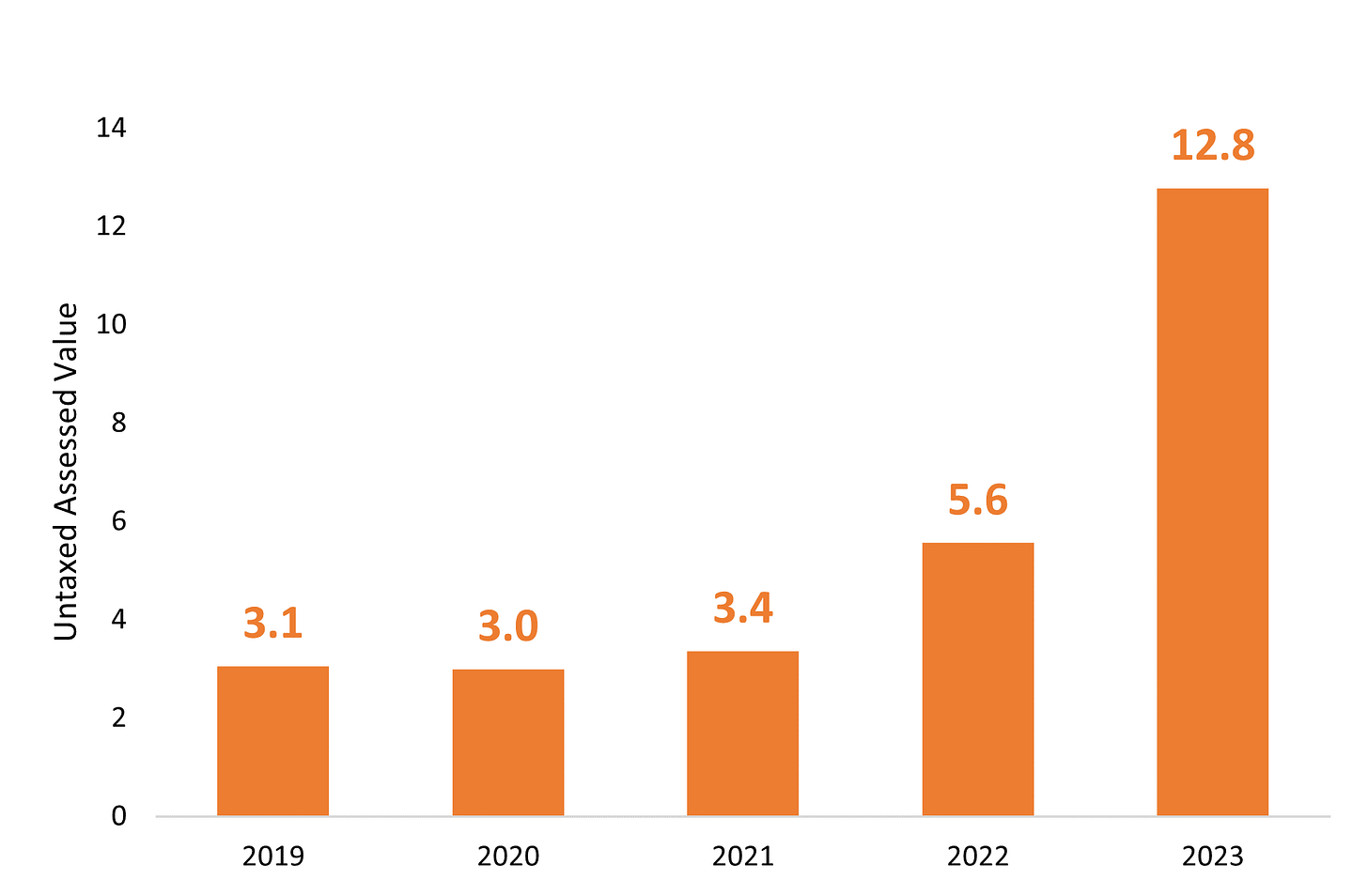

Rising Cost of Tax Sheltering

Across HRM, the gap between assessed values and taxable values has reached $12.8 billion in 2023, costing the city $100 million in annual revenue (about ~10% of the city budget, or equivalent to funding for the Halifax Regional Police).

The benefits aren’t spread equally. Even within property owners (already excluding renters), about 36% of the tax savings accrue to properties with an assessed value above $500,000 (only 12% of properties are valued above $500,000).

It’s easier to see geographically. The map below shows assessed home price (dot size) and untaxed housing wealth (color). Many of the big dots ($1m+ value), are also darkest (500k+ of untaxed wealth). Why do these homeowners need tax breaks at all?2

Assessed Property Value (dot size) and Untaxed Wealth (Color)

Finally, I said homeowners, but I should have said properties. That’s important, because eligibility for CAP is not restricted to your principal residence (this is baffling).

If you live in Nova Scotia and own a non-Condo property with less than four units (62% of HRM housing stock is one to four units), your investment properties are eligible for the CAP! That means landlords could have not only their residence CAP’ed, but entire portfolios of CAP’ed properties. My landlord has my duplex valued at $587,000, but they are paying taxes on only $312,000, an annual tax savings of $3,000. What possible reason would my landlord need such a generous tax break, on top of their enormous profits?

For these landlords, the CAP is a barrier to exit. Selling resets the value for the new owner, ending the tax savings3. Might as well hold on as long as possible. Ending the CAP immediately for investors would raise revenue4, and *assuming it has any behavioral response at at all* cause investors to sell some of their homes. That’s exactly what the resale housing market needs right now, more inventory.

To sum up, the Capped Assessment Program:

Costs the city about $100m annually in revenues (and growing)

Delivers those tax savings to the upper half of the income spectrum

Delivers it unfairly, with pricier homes having bigger savings

Allows investors to build portfolios of CAP’ed properties, and discourages ever selling

The policy is horrible, and ending it might be the perfect tax hike5. In my view, any party should want to end this, at the very least so that they don’t have to defend it. But I think the Nova Scotia NDP are probably best placed to do it.

The Dexter NDP government started this mess in 2008 by setting CAP to inflation (it was 10% from 2005-2008). It’d be a good break from the past.

In the 2021 election, the NDP ran on progressive property taxes for homes above $1M, which would be severely blunted if CAP still existed

It’s housing related, an issue the NDP are trying to claim

It addresses the financialization of housing, especially the investor bit

It raises revenue for the province and municipalities, which can be used to build public housing (housing wealth paying for housing!)

So, c’mon dippers (or anyone).

If you bought in 2018 with 5% down and a 3% rate, that’s a (super rough) annual rate of return of 50%+. That’s Wall Street legend shit for a single year. Compounding that rate over 5 years is impossible outside of Renaissance.

The dominant issue in the economy currently is inflation. There is too much money being spent. It gets solved by sucking money out through taxes, or with job losses spurred from interest rate increases. We should be looking for ways to raise taxes on rich people (who have the extra money they didn’t spend during COVID)

You can actually sell to family and retain CAP values, because what we in this world is more intergenerational wealth transfers.

I don’t know what share of CAP tax savings are for landlords

Even California’s infamous prop 13 (which is similar) doesn’t have an investor clause

What I find missing in this discussion is how the cap program also discriminates against new and first-time homeowners by forcing them to subsidize taxes for existing homeowners, not just the elderly. It's extremely unfair.

Misery / disbelief / disappointment: my situation as a senior who has tried to get reasonable answers & some useful direction. I recently had a (so called) adjudication & very clearly asked for a copy of the minutes... Still waiting on that. I did receive a confusing letter from NSAAT w no direction other that to make an appeal. (Oh Yay) I thought that was what we did! Their message states that if I am not satisfied then then I can make (another) appeal. Good Lord, I honestly thought that this is why we had the teleconference following my letter of appeal! So, much for helping to keep seniors in our homes! Incidentally, I did suggest that it is time to get themselves organized & have an up to date directive to where we van find good guidance w contact data which they did not possess. Both the 'Judge' & the ?NSSAT employee agreed that this made good sense.