The Folly of Pre-Construction Condos

Leveraged bets make geniuses when they work, and don't work forever

Imagine going to your financial advisor with a lump of money, and getting a recommendation to use your $40,000 to borrow $200,000 worth of stocks and then come back 3-5 years later. That might sound risky, but that’s exactly how Ontario funds about 40% of its new homes, by collecting pre-construction deposits (basically down payments) before building.

“Pre-construction” condos collect deposits from investors, which greatly helps them pay for construction and secure other loans from banks to build the building. Historically, some 70% of condo units would be spoken for before construction starts1.

From the future owners perspective, this is best thought of as a leveraged “bet” that condo prices will go up. Given that condo buildings can take up to 5 years to actually build, your hope is that house prices will go up by the time the building finishes. At that point, you can sell the unit, or move in yourself. But either way, you invested $20 to get a claim on an asset that’s worth $100 +/- wherever prices go between the deposit and the completion of the unit.

Boomer Parlays

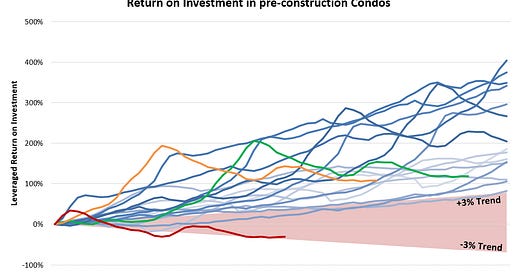

Historically, this has worked tremendously well, year after year. Since 2005 onwards, GTA condo prices have nearly always been higher after 5 years. From 2005 to 2019, the average change in condo prices after 5 years was +45%, with a range of +15% to +80%.

But those are just the price changes, the return on investment is greatly amplified by the fact you’ve only had to put up the 20% deposit. In simple terms, this increases the return (in both directions) by 5x. That’s the real kicker here, it drives the profits into the stratosphere.

In 2005, your 20% deposit would cost $37,820 for the average condo worth $189,100. But by the time the condo would be finished in 2010, the worth was worth $259,100, meaning your $37,820 deposit earned you $70,000 of profit. Later years show even wilder gains, tripling or quadrupling your money.

You don’t need to be a financial expert to know that investments that can pay-out like this are not possible without high risk and most likely, extreme leverage (borrowing). It’s also no surprise why folks kept doing it. It kept working! Even buyers in early 2021 could have doubled their initial investment by early 2022.

But as you can see from the chart, the tide has shifted for now. Condo buyers from 2022, most of whom are probably still waiting on construction to finish, have likely lost money. Prices have dipped ~6% since January 2022, which means your deposit has lost 31% of its value (including the leverage).It’s no surprise that condo sales are in free fall.

The strategy has stopped working for now. And the stakes have risen incredibly. While the $37,000 deposit in 2005 is a good amount of savings, a 20% deposit today is more like $130,000. And don’t forget, you are also legally committing to get a mortgage to pay for the other 80%. Not many, even investors, can afford to pay a $500,000+ mortgage for an investment property.

The takeaway is that Ontario’s obsession with condos & pre-construction financing is a mistake. It’s a mistake that worked tremendously well for 15 years, but it is and was still a mistake. It’s a mistake that will be painful for many for years to come. And the sooner Ontario stops expecting mom & pop investors to make wild, leveraged bets to fund its construction industry, the better.

Source missing - I saw a chart somewhere on this…

Wondering how you think a better funding model for construction of these units would look?