It’s municipal budget season in Halifax. Inevitably, that leads to a debate about property taxes, which account for 75% of HRM revenues. Unfortunately, most city councils are crippled by anti-tax sentiment, Halifax included. There are many reasons for that, but Halifax’s deputy mayor, Sam Austin, sums it up pretty well: anytime you touch property taxes you are accused of forcing grandmas out of their homes1.

If you want a city that does things - like running ferries, building pools or bike paths, or heck even roads, you need a shield from that basic attack of an anti-grandma agenda. I think it’s a shame that even “dismantle capitalism” left-wing groups don’t really talk about property taxes, so, I thought I’d give it my best go. Come along, comrades.

Poor people do not own assets

poor people do not own assets,

poor people do not own assets,

poor people do not own assets.

Property taxes are an asset-based tax, that homeowners pay. It’s really that simple. Some folks imagine a “pass-though” to renters. That is wrong, or more precisely incredibly small. Property taxes should only affect rents though their impact on new construction. New construction is typically less than 2% of the housing stock (i.e. 98% of property taxes come from already-built buildings), and we have much more significant taxes & fees on new construction than property taxes. So that being said, property taxes target homeowners, which are (generally) the upper two-thirds of the wealth distribution.

Property wealth isn’t spread equally

Moreover, even among homeowners, property wealth isn’t spread equally. If you raise property taxes, you will overwhelmingly raise them on the wealthiest property owners. So far, this is nothing new. And yet, that’s clearly not enough of an argument in the status quo. It doesn’t matter how “progressive” tax hikes are, any tax hikes on “people like me” seem like non-starters. I first heard this dynamic about the Bush tax cuts. Basically, Americans didn’t care that it was a mostly giveaway to the rich, as long as they got some tax cuts themselves. That’s the status quo: the risk of charging grandma $20 a month more is too high, even if we get hundreds out of millionaires.

But it still matters that some homes are worth 3 times or 5 times or more what many “regular” peoples’ homes are worth. And, it’s an opportunity to play some technocratic games. But first, a data note for anyone who cares in the footnote2

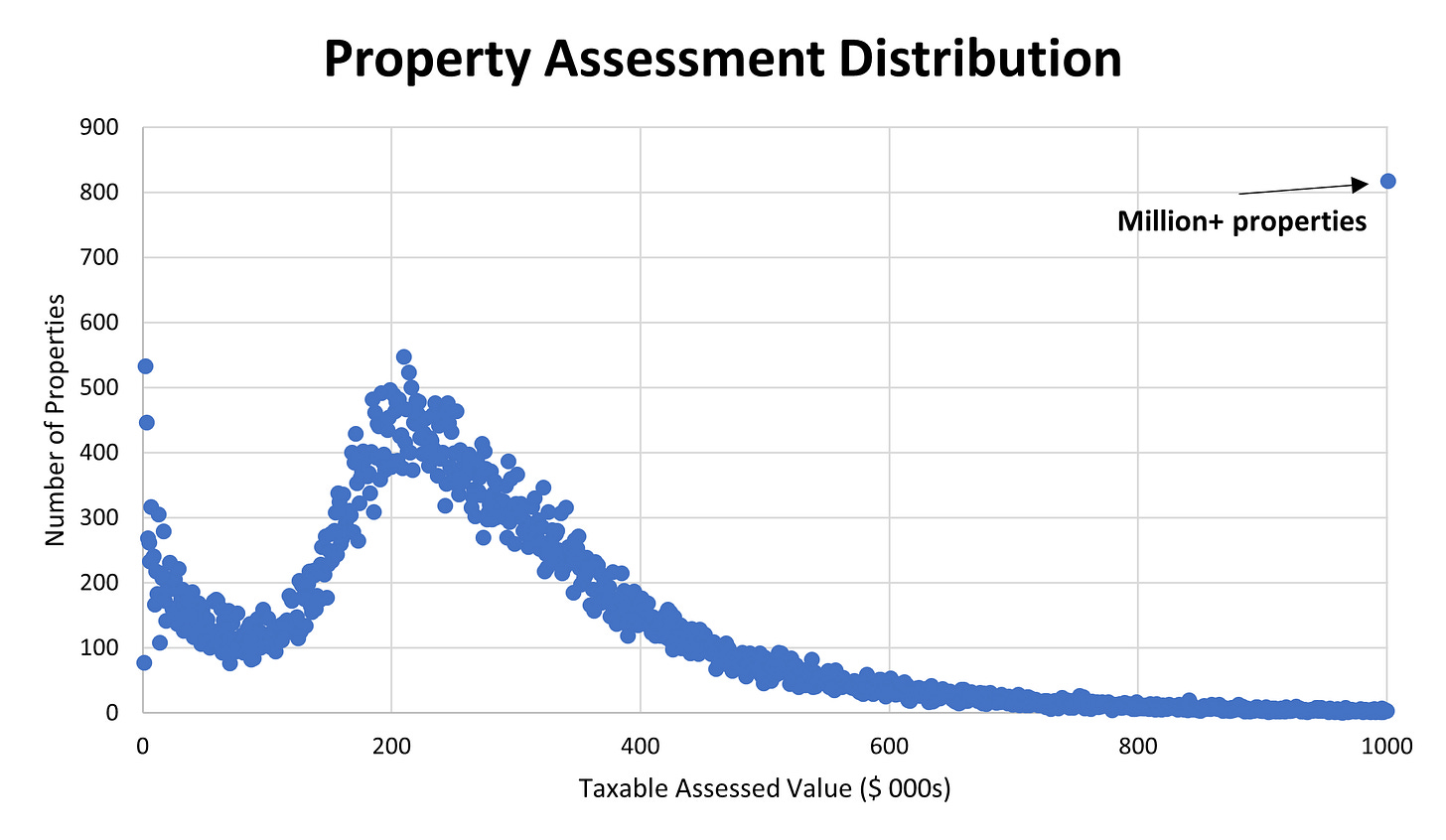

I’m showing the distribution of taxable property assessments here, which has a long tail of valuable properties, that can be exploited. If you set up a lump-sum rebate while increasing the tax rate, you can effectively target the upper sections of property values while fully offsetting or minimizing the tax impacts on many. There are other ways of doing this, but the fixed-dollar rebate is the simplest.

Deny’s Double-double with Checks on the side

Currently, HRM’s property tax rate is 0.76% (there is a provincial rate too). Imagine this: we double it, to 1.5%. At the same time, a new tax rebate program is launched3, giving fixed-dollar rebates worth $2,350 to every property owner (note: the tax bill can’t go negative though). It’s essentially like a new 0% property tax bracket4, which will cover many low-income property owners, who will generally own low-value properties.

Across HRM, the impact of this policy change would look like this:

20% of property owners (25,000 total) would not pay any property tax at all anymore, as the rebate is larger than their tax bill. In 2023, this would be basically anyone with a taxable assessment less than $155,000 (on average that’s an actual assessment of $230,000). The super small value properties included here might be a mix of mobile homes and land parcels, but my data doesn’t tell me what the mix is.

Another 45% of property owners would get a tax cut compared to today, but still pay some property tax. That means two-thirds of property owners will see taxes fall. How’s that for working class politics! Grandma’s going to bingo tonight!

Finally, 33% of property owners, those with taxable assessments beyond $300,000 will receive a tax increase. Even there, the tax increase will scale by how valuable your home is. With a taxable assessment of $500k, your tax bill would rise 35% including the rebate (about $100 a month). By the way, only 10% of HRM properties have a taxable assessment of 500k or more - these are the upper-class (note: excludes apartments).

Total revenue collected would be flat. Huge tax cuts would be delivered to many, and tax hikes sent to those who can handle them most. Note, this excludes the extra revenue generated from apartments, which are not in my dataset.

Obviously, the doubling would be an big shift, even if the rate would still be less than Cape Breton and many parts of the U.S. But the concept can be used for any desired revenue. Halifax has had huge issues recently raising tax collection by even 8%, as negative stories inevitably pour in. The tax hike+rebate scheme could be a way to neutralize that bad press.

The data I have doesn’t inform this, but the benefits would be turbocharged if the rebate was only for a principal residence. There are many small-time property investors in Nova Scotia (who also enjoy the benefits of CAP’d assessments) but they aren’t a sympathetic group - and can afford to have their investments pay a little more tax.

There is still the issue of the senior who owns a $700,000 home who feels poor because their income is limited. But cutting tax rates for them is a policy dead-end, that can only lead to scenarios like in Vancouver, where homeowners with $3.7 million dollar homes pay $15,000 a year in property tax. There should be generous deferral programs for seniors (there always is), but the tax bill should be collected at some point (there are options when you are sitting on hundreds of thousands in wealth). There are always sad cases, but the degree to which we are making policy on account of anecdotes is really bad.

Playing Progressive

While the province may be more conservative, Halifax is a progressive city (the Liberals and NDP won 70% of the vote in the 2021 provincial election). And we have many city councilors who proudly call themselves progressives, and wish to pursue progressive policies.

I just don’t think it’s good enough for openly progressive leaders to repeatedly cut property tax rates, when the benefits of those tax cuts are so obviously skewed to well-off property owners. Especially when they are paired with budget cuts.

This year, when combined with the CAP (which freezes taxable assessment with inflation), council handed an inflation-adjusted 4% tax bill decrease to most property owners. A similar cut was made in 2022. For someone who’s lived in the same home since 2010 - your inflation-adjusted tax bill is about 20% below what it was a decade ago - despite soaring prices.

For next year, we should expect better from our progressive leaders than another round of poorly targeted regressive tax cuts.

Epilogue: For All the (Data) Dogs

I’ve written about CAP’s impact on assessments before, but just have to share this chart of the impact on assessments. What do you see?

Sam’s tweet was referring to the provincial Property Tax assessment cap program

The data show below and used for modeling is from Datazone/PVSC, which has every property in HRM. Unfortunately, the big dataset doesn’t specify whether the property is commercial or residential, or the residency status. So, I am filtering for properties that have CAP’d assessments, which guarantees they are residential but will exclude large apartments, some new homes, and some homes that have sold in the past year. FWIW, my dataset contains 125,000 properties worth $35bn in taxable assessments, which is good coverage (I’d guess 90%+ of the individually owned real estate in HRM - no one cares how much apartment owners in pay property tax anyway)

This might need to be a spending measure like checks, if the province feels like you are undermining their tax assessment system (which you sort of are)

Fiscal tricks reminder! Any sort of tax measure can also be restructured as a spending measure. Hence, if the province doesn’t like the idea of a 0% bracket, you can do the direct checks instead, call em “Savage bucks” or something fun.

Deny,

Thankyou for showing us the Data!

Grand Ma can go to Bingo tonight if she understands the rest of the story.

Grand Ma is a pawn, used as a cover up to keep the rich from paying our fair share.........

Hey, health care costs a lot and we all use it! Now is the time for cities and towns to say the same when we all use the washroom!

How can we vote for this plan of action?