Extending Mortgage Amortization is a Mistake

More money chasing too few homes is a recipe for higher prices

Last week, Prime Minister Justin Trudeau teased changes to mortgage rules coming on budget day (the 16th of April). That followed a piece from iPolitics where Tyler Meredith (a former Trudeau advisor) and Mike Moffatt (an all-around housing guru) spoke about one change, a mortgage amortization extension for first time homeowners.

Tyler and Mike didn’t write the iPolitics piece, so this isn’t their fault, but there is very little numerical analysis in their arguments in favour of the change.

The Numbers

The basics argument is that many Canadians cannot afford to buy a home. This is especially true for Canadians who don’t already own a home (because homeowners have made loads of money, which they can use to get smaller mortgages). Therefore, we should help new home buyers get into the market by extending the amortization (for first time homebuyers), which will lower the monthly payments, and make it easier for them to buy homes.

And it’s true, if you have a $500,000 mortgage at a 5% rate, and you will pay nearly $250 less per month if you amortize over 30 years instead of 25 years.

The Problem

So far, that sounds helpful. $250/month is real money, and could help me afford a mortgage. But it would also help all the other first time home buyers. According to the Bank of Canada, first time home buyers are typically about 50% of home buyers (repeat buyers / movers are another 30% and investors the remaining 20%).

The problem with mortgage amortization extensions is that it can also simply push up the price of homes, offsetting the affordability gains, benefitting existing homeowners and straddling new buyers with even larger mortgages. Viewed differently, mortgage amortization would allow about half of home buyers (and likely many more wanna-be buyers) to borrow another 10% ($45,000). If prices rise that much, the monthly payment returns to the original level.

We can’t know what the price response will be today, but we should expect it to be large. Even though its risen from the pandemic lows, housing inventory remains dreadfully low.

In short, there aren’t many homes to buy, and it’s likely the person you are competing against would also take on a 30-year mortgage (first time home buyers are also most likely to borrow everything they can). My random guess would be that over half the benefit would be lost through higher prices.

Finally, its worth mentioning that this “benefit” isn’t actual savings. It’s simply pushing higher costs into the future. I think this policy reeks of an intergenerational bailout - the kind of “stealing from our kids” move that is the entire problem with big house price booms.

A better idea (in Nova Scotia)

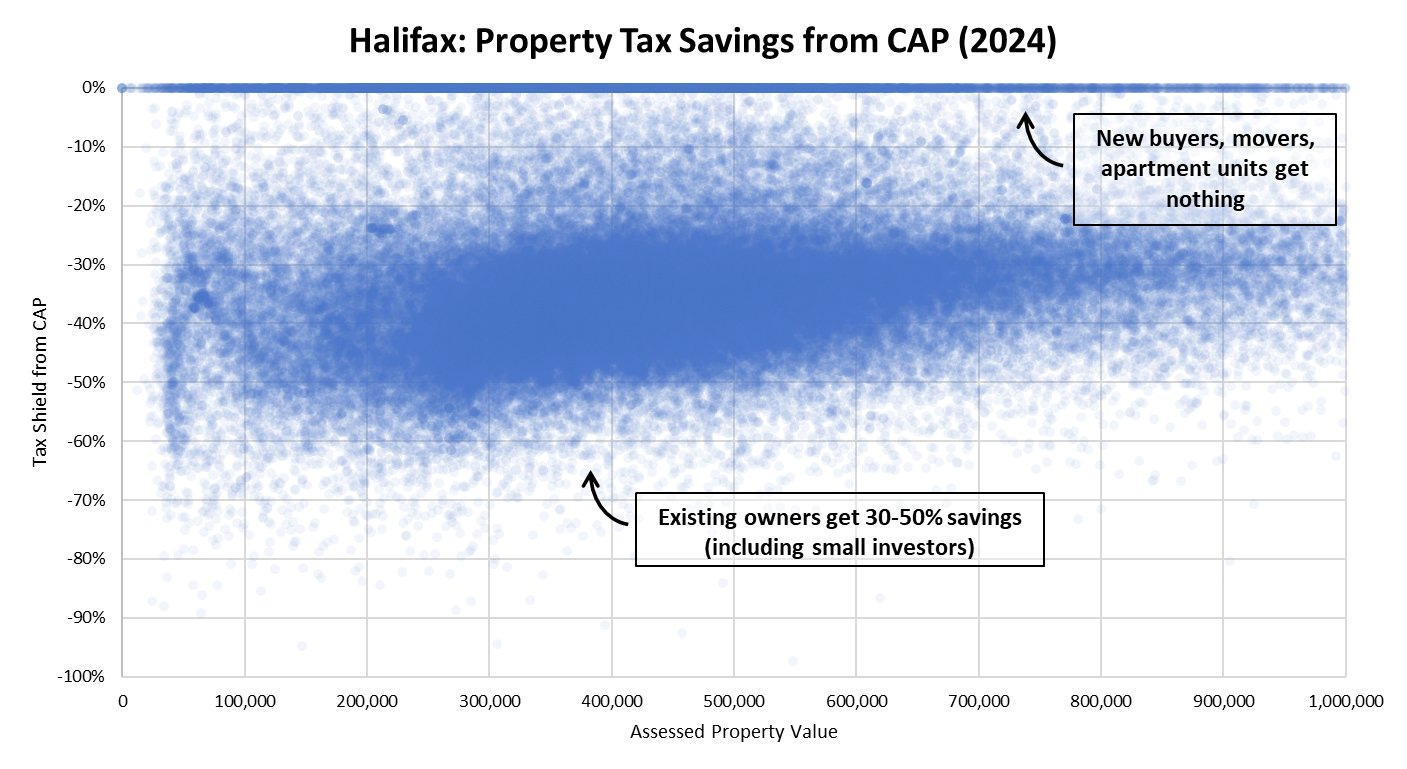

Instead of just allowing increased borrowing, the Nova Scotia government should allow first time home buyers to hold onto “Capped” property assessments. Currently, most homeowners property assessments only increase by inflation, regardless of how much house prices rise. Given the recent boom, a huge gap has emerged for most homes (rental apartments are exempt, but condos are covered).

But property assessments reset to market assessments upon sale1. That means that a new home buyer will face somewhere between a 60%-100% increase in property taxes - immediately and forever.

On a home assessed at $500,000 and a 1% property tax rate, holding onto the cap can save most first time homebuyers between $125 and $210 (based on a typical CAP discount of 30%-50% to assessed value). These are real savings - not borrowed money.

It may even help homeowners decide to sell and downsize, knowing that their massive tax benefit isn’t disappearing into government coffers.

Except if you sell to a family member - more intergeneration wealth transfers, please!

Great article Deny!

Deny,

Who knew a longer amortization was a bad think for new home buyers?

Capped property taxes needs to be explained more in laymen's terms and what are the side effects down the road?